Technology can help in enabling access to judicial services at finger tips

03 Feb 2024

Opinion: Nandan Nilekani.

Nyaya Setu, being built to ensure reach of legal services till the last mile, will put together all legal knowledge in finger tips, in the language of people’s choice and it is built using GPT and AI models, says the founding chairman of UIDAI

Nandan Nilekani, the founding chairman of the Unique Identification Authority of India (UIDAI), on Friday said through use of technology, access to judicial services can be enabled at finger tips.

Nandan Nilekani, the founding chairman of the Unique Identification Authority of India (UIDAI), on Friday said through use of technology, access to judicial services can be enabled at finger tips.

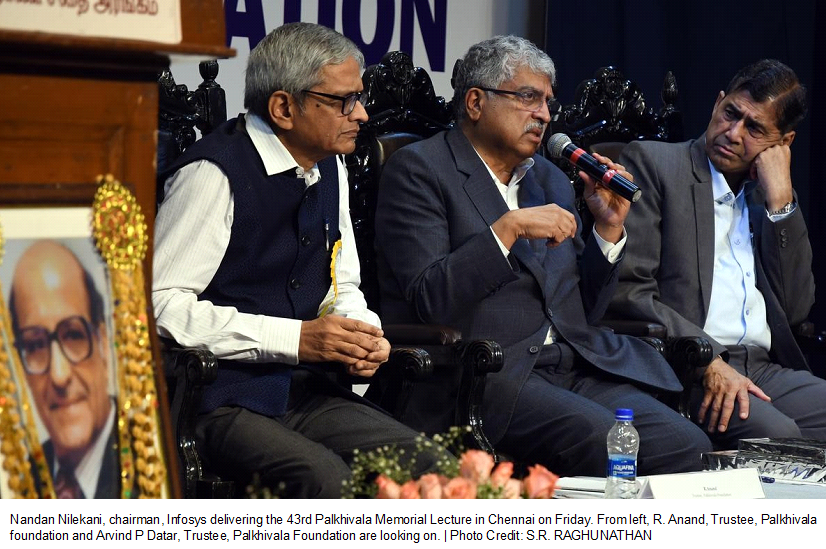

We have made identification simple through Aadhaar and payments easier through the Unified Payments Interface. Access to legal services could be made as simple as access to payments,” he said, delivering the 43rd Palkhivala Memorial Lecture on the topic “India’s Digital Transformation: a new path for economic growth?”, organised by the Palkhivala Foundation in Chennai.

“If I told you in 2015 that there will be 350 million people who can make payments using QR code, one would say it would be impossible. But, it happened, right,” Mr. Nilekani said, while stating that the same can be possible in judicial services.

He said the Nyaya Setu, which is being built to ensure reach of legal services till the last mile, will put together all legal knowledge in finger tips, in the language of people’s choice and it is built using GPT and AI models.

Mr. Nilekani, chairman and co-founder, Infosys said the way forward to use technology in judicial services is not trying to automate individual tasks, but to take a couple of high-volume repetitive case types and automate them fully.

Two case types that are being looked at by the judiciary and others are cheque bounce and motor vehicle disputes — these two case types constitute nearly 20 per cent of all cases that are pending, he said.

This can be rolled out in a couple of High Courts, and if proven, it can be replicated in others, Mr. Nilekani said.

He also said another mechanism is the Online Dispute Resolution (ODR) system, which is scaling up rapidly.

India has built the world’s largest ODR system. There are 110 enterprises, including 60 in the banking and financial sector alone who have embraced ODR. Over ten states are doing online Lok Adalat using the ODR system, Mr. Nilekani said.

He added, 70 million disputes have gone online in the past five years. The resolution rate is about 15 per cent but it is slowly increasing as they are getting more efficient.

“The combination of using the ODR system to take on the new, smaller cases like financial disputes and the regular judicial and legal system taking on two case types — cheque bounce and motor vehicle — we can start solving on both sides, showing the people what is possible,” Mr. Nilekani said.

Published in: The Hindu, 03 Feb 2024

Nandan Nilekani, the founding chairman of the Unique Identification Authority of India (UIDAI), on Friday said through use of technology, access to judicial services can be enabled at finger tips.

Nandan Nilekani, the founding chairman of the Unique Identification Authority of India (UIDAI), on Friday said through use of technology, access to judicial services can be enabled at finger tips.