A remedy for health insurance

23 Feb 2023

Opinion: Debasis Barik

Ayushman Bharat: These schemes have a good coverage. But funds use will suffer, if people are unaware of entitlements

The introduction of social health insurance has been one of the most significant innovations of the past decade. While public health spending (including both Centre and States) has seen only a marginal increase over the last decade, government spending on social health insurance has increased consistently. Spending on social health insurance (at current prices) has almost doubled between 2013-14 and 2018-19.

Meanwhile, the government in September 2018 revamped the existing Rashtriya Swasthya Bima Yojana (RSBY) and introduced the Pradhan Mantri Jan Arogya Yojana (PMJAY) or Ayushman Bharat scheme with an aim to expand the services to a larger number of households. The annual coverage also increased to 5 lakh per household as opposed to 30,000 in RSBY. A surprising aspect of the Budget 2022-23 was that Ayushman Bharat did not receive a single mention in the speech.

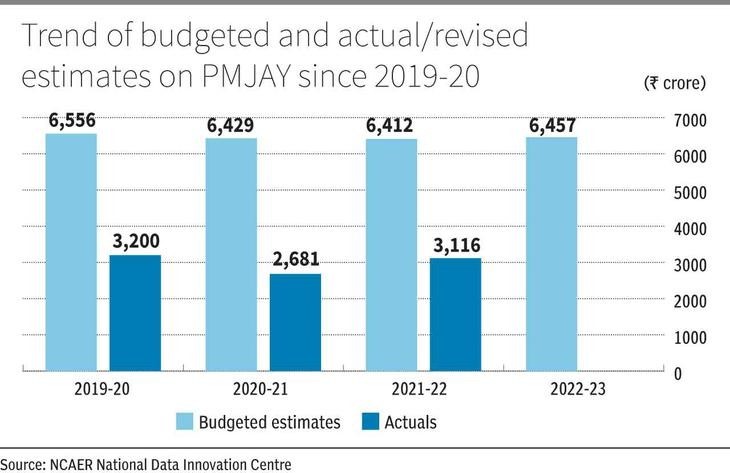

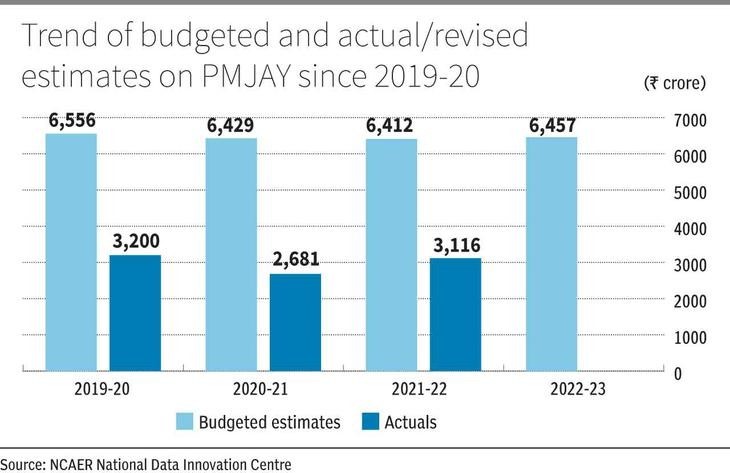

According to the estimated demand and expenditure for PMJAY by the 15th Finance Commission on Ayushman Bharat (2019), the total costs (Centre and States) of PMJAY could range from ₹28,000 crore to ₹74,000 crore for the next five years. However, we did not see an expenditure of this order for PMJAY since its inception. In fact, actual spending was much lower than the budgeted estimates over the last three Budget periods (Figure 1).

Expanded coverage

There can be no denying that coverage has expanded vastly, although meeting the initial target to cover 10.74 crore families (or nearly 55 crore individuals) from the lowest socioeconomic strata may take some time. However, access to PMJAY cards is not the same as using them. The utilisation of the amount allocated to the scheme has been poor. While 83 per cent of the Budget allocation was utilised in 2018-19, the utilisation decreased to 50 per cent in 2019-20, and to 42 per cent in 2020-21. With the pandemic raging in these two years, this decline is surprising and implies gaps in the implementation of the scheme.

While it can be argued that the use of funds for social insurance can be unutilised if the claims are less, it is also a fact that lack of awareness has played a major role here. NCAER research brings out lack of awareness on the part of the beneficiaries about the health benefits for which they are eligible and the process of accessing them. In 2019, National Data Innovation Centre at NCAER examined the knowledge and perceptions of health insurance beneficiaries regarding their entitlements from the schemes.

We assessed the knowledge of benefits and entitlements of various social health insurance schemes among the households in the Delhi NCR region who had access to a health insurance scheme over one year, 2019-20. We found that a significant proportion of the beneficiary households lack useful knowledge of their entitlements. Moreover, some of those who reported having knowledge turned out to have incorrect knowledge. We also examined the knowledge of beneficiaries about the entitlements and benefits of a popular health insurance scheme from Rajasthan. Before it got merged with PMJAY, Bhamashah Swasthya Bima Yojana (BSBY), the flagship health insurance programme of the Government of Rajasthan, used to provide an annual health cover of ₹30,000 for general illnesses and up to ₹3 lakh for critical illnesses. Besides hospitalisation coverage, the scheme also covered outpatient expenses for seven days before and 15 days post-hospitalisation. But when asked if members of the beneficiary households were aware that BSBY scheme covered outpatient expenses for the pre- and post-hospitalisation periods, 14 per cent of them reported that they were not aware of the same.

Among the remaining 86 per cent of the beneficiary households, 48 per cent reported that BSBY didn’t cover any pre- and post-hospitalisation expenses — which was not correct.

Awareness deficit

Similarly, a third of the beneficiary households did not know that BSBY pays for pregnancy and delivery-related expenses. This incorrect knowledge often leads to lower utilisation of the defined benefits of such schemes. Less than one-third of the individuals with insurance in the Delhi NCR region actually claimed their benefits in the event of hospitalisation.

If we expect to achieve universal access to healthcare through the provision of health insurance schemes, it is important to enhance knowledge about the scheme’s benefits and entitlements among the beneficiaries. Increasing coverage alone is not sufficient to achieve the goal. Without devising proper strategies to inform the card holders about where to go and what to claim, the vision of achieving comprehensive health will remain unattended. At this rate, each Budget may only see only a reduction in outlays due to lack of utilisation.

The writer is a Fellow at the NCAER. Views expressed are personal

Published in: The Hindu Business Line, 23 Feb 2023