Has the RBI Pivoted?

10 Apr 2023

Opinion: Poonam Gupta.

During his post-monetary policy media interaction last week, RBI Governor Shaktikanta Das declared that the central bank has paused, not pivoted. After raising interest rates by a cumulative 250 bps, in six consecutive meetings during the period May 2022-February 2023, the RBI decided to keep the policy rate unchanged in its first monetary policy meeting of 2023-24. Simultaneously, it reiterated its commitment to bring inflation down to 4 per cent from the current level of about 6 per cent.

Why did the RBI pause its tightening streak? What would be its future course of action: will it continue to pause; raise; or lower the policy rates in the coming months?

The recent pause can be attributed to a number of factors. First, the Indian economy seems remarkably resilient despite persistent global turmoil manifested in the stubbornly high inflation in advanced economies; multi-decadal high interest rates; a banking crisis, which was thankfully contained; and sequential growth downgrades.

The RBI has upgraded projections for GDP growth for 2023-24 slightly to 6.5 per cent from 6.4 per cent; and has lowered the projected inflation to 5.2 per cent from 5.3 per cent. In addition, the banks and Non-banking Financial Corporations (NBFCs) are holding up well on asset quality; the exchange rate has stabilised; and the volatility of capital flows has subsided. The latter has enabled the RBI to build its forex reserve buffer back to the $ 600 billion-odd level.

In the absence of any compelling reasons for a monetary policy action, a pause seems like an eminently sensible decision.

Second, given the lag with which the full transmission of monetary policy takes place, it would be appropriate to allow time for the past rate hikes to work their way through the system. For example, till date, banks have transmitted only about half of the past rate hikes into deposit and lending rates. The transmission through other formal and informal financing channels has also likely been incomplete.

Third, given the pervasive high inflation rates and negative policy interest rates in the advanced economies, the RBI’s inaction with inflation hovering around 6 percent carries very little credibility risk. Besides, the decline in household inflationary expectations has boosted the RBI’s credibility further and will assist in keeping inflationary expectations anchored.

In order to anticipate RBI’s future course of action, one needs to look beyond short run, cyclical considerations. Instead, it would be useful to analyze the evolution of RBI’s approach toward monetary policy over the past several years; including the relative weights attached to inflation and growth.

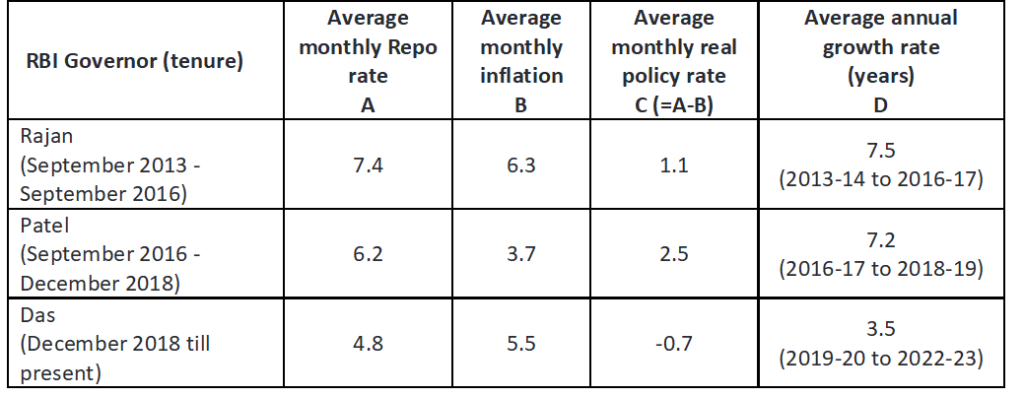

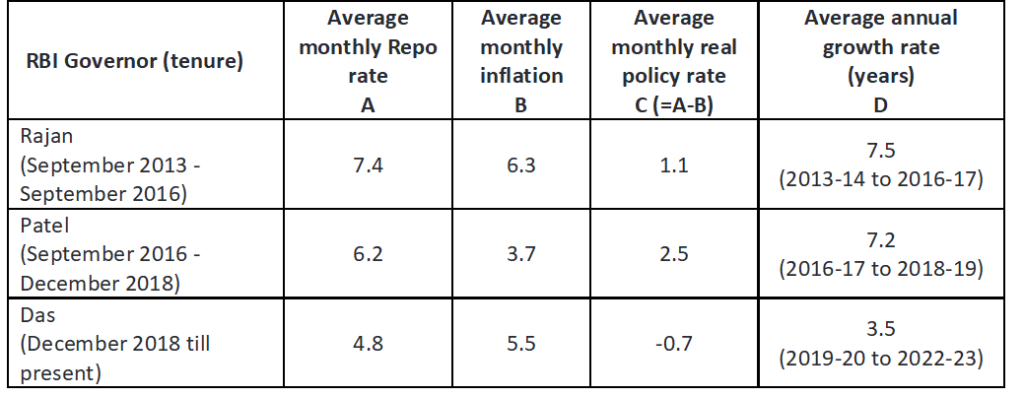

A comparison of the average monthly inflation rate, repo rate, and real interest rate, during the consecutive tenures of RBI Governor(s) Raghuram Rajan, Urjit Patel, and Shaktikanta Das offers interesting insights (see Table 1).

Table 1: Inflation, Growth Rates, Interest Rates, and Real Interest Rates during Different Regimes

Both inflation and policy rates were high during Rajan’s tenure during September 2013-September 2016, averaging 6.3 per cent and 7.4 per cent respectively, resulting in an average real interest rate of 1.1 per cent.

Inflation declined drastically during Patel’s tenure (September 2016 – December 2018), but the repo rate did not decline as rapidly. Consequently, the real interest rates more than doubled to 2.5 per cent. The annual GDP growth rate was slightly slower during Patel’s tenure, suggesting a hawkish regime.

The tenure of Governor Das, since December 2018, has coincided with a polycrisis resulting in a sharply decelerated average GDP; and elevated inflation. Despite average monthly inflation accelerating to 5.5 per cent, the policy rate has declined, yielding a negative real interest rate.

Evidently, the RBI has pivoted monetary policy to address concerns related to growth more than those concerning inflation in recent years.

Currently, risks to growth outweigh risks to inflation, both globally as well as in India. The RBI will either continue to pause or will cut rates during coming months, if such risks to growth materialise. It is unlikely to tighten even if inflation remains at the 5.25-5.5 ballpark level.

In its recent actions, the RBI seems to have resolutely pivoted toward a more flexible interpretation of the inflation targeting regime, than has been the case in the past.

It should serve the economy well under the circumstances.

Published in: The Economic Times, 10 Apr 2023