India’s growth rate and the sanctity of GDP deflator

20 Sep 2023

Opinion: Poonam Gupta and S Priyadarshini.

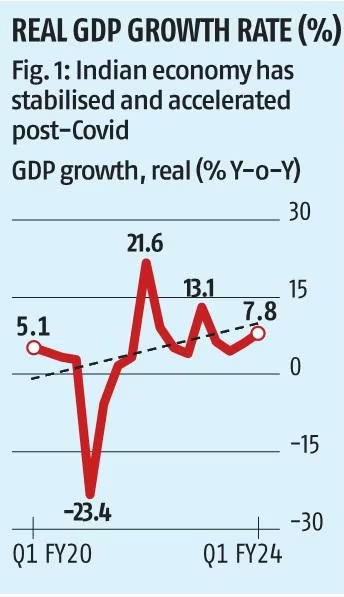

The real growth rate of the Indian economy in the April-June quarter of 2023-24 (Q1, FY24), according to the latest data released by the Central Statistical Office (CSO), stood at 7.8 per cent. Market economists embraced this data as reflective of their own projections, and in line with their consensus forecast. After factoring in the base effects, monsoon, external conditions, and the high-frequency indicators, they projected the full-year growth rate to be close to the Reserve Bank of India’s (RBI’s) forecast of 6.5 per cent.

Meanwhile, Arvind Subramanian and Josh Felman (henceforth AJ), presented a contrarian view on the data in an article published in Business Standard. Questioning the sanctity of the estimates of the gross domestic product (GDP) deflator, AJ made three claims. First, the Indian economy has been decelerating sharply. Second, there is an inexplicable anomaly in the calculation of the GDP deflator. And third, the deceleration in the economy is corroborated by disaggregated national income data.

AJ’s assertions are based on arbitrarily selective and incomplete information, resulting in misleading conclusions. Our analysis, presented below, plugs these gaps in AJ’s analytical approach and narrative, for each of the claims made by them.

(i) The Indian economy is not decelerating. It has stabilised after Covid

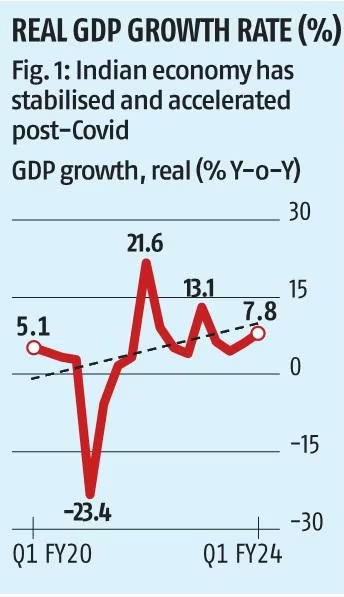

Figure 1 shows the quarterly year-on-year (Y-o-Y) real GDP growth rates from Q1 FY20 till Q1 FY24. The line of linear fit shows an economy that has been accelerating. It clearly indicates that the economy contracted during Covid, recovered sharply the next year, and has thereafter been undergoing gentler recovery and acceleration.

Figure 1 shows the quarterly year-on-year (Y-o-Y) real GDP growth rates from Q1 FY20 till Q1 FY24. The line of linear fit shows an economy that has been accelerating. It clearly indicates that the economy contracted during Covid, recovered sharply the next year, and has thereafter been undergoing gentler recovery and acceleration.

How did AJ then conclude that the economy was decelerating?

They did so by comparing apples with oranges. They mixed up annual data (for FY21 and FY22) with half-yearly data (for FY23) and quarterly data (for Q3 and Q4 FY23, and Q1 FY24) in order to suit their priors.

The right approach is to compare data at the same frequency (be it annual, quarterly, or any other), over a representative period, as we have done in Figure 1.

Additionally, AJ used nominal GDP growth for their analysis. Doing so is inadvisable even during normal times, for they confound real growth with inflation. The nominal GDP series have grown slowly all around the world in recent months due to inflation receding from high multi-decadal levels. For example, even as the US economy grew at 10 per cent in nominal terms during 2021 and 2022, the nominal and real growth rates have now started to converge due to moderating inflation. Any conclusion of a real deceleration based on nominal GDP data is thus erroneous.

(ii) Low inflation in the GDP deflator is a technical, explicable phenomenon

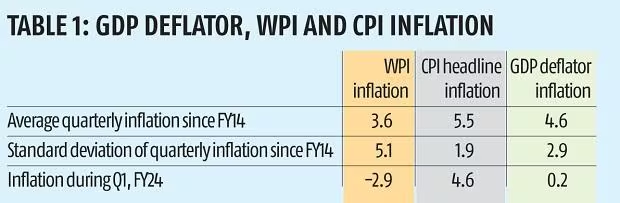

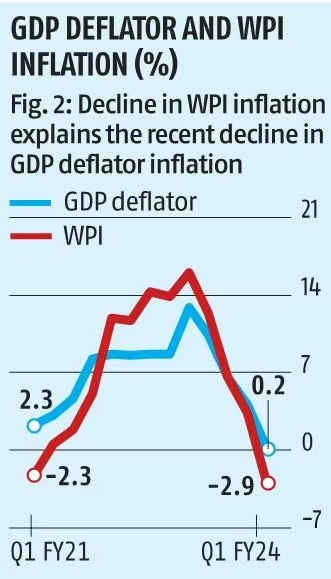

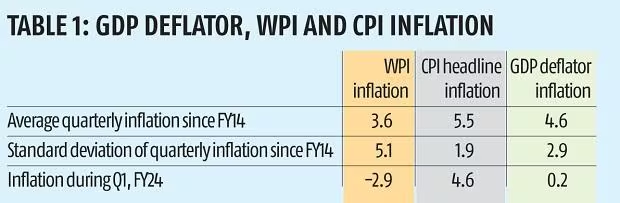

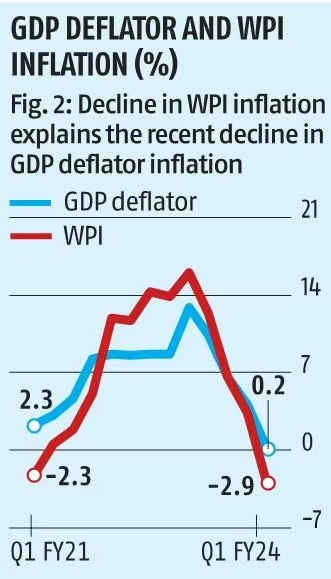

The narrowing gap between the real and nominal GDP growth rates in recent quarters, which AJ highlighted, emanates from the fact that the GDP deflator in India is a weighted average of the inflation rates based on the wholesale price index (WPI) and consumer price index (CPI).

The GDP deflator correlates more strongly with the WPI-based inflation (a correlation coefficient of 0.88) than with CPI-based inflation (a correlation coefficient of 0.39). In other words, WPI has a larger de facto weight in the GDP deflator than CPI. Over the past decade, the average WPI-based inflation rate has been lower than the CPI-based inflation rate (3.6 per cent versus 5.5 per cent), and two and a half times more volatile, lending volatility to the GDP deflator too.

The GDP deflator correlates more strongly with the WPI-based inflation (a correlation coefficient of 0.88) than with CPI-based inflation (a correlation coefficient of 0.39). In other words, WPI has a larger de facto weight in the GDP deflator than CPI. Over the past decade, the average WPI-based inflation rate has been lower than the CPI-based inflation rate (3.6 per cent versus 5.5 per cent), and two and a half times more volatile, lending volatility to the GDP deflator too.

Due to a cooling of international oil and commodity prices, the WPI-based inflation rate has declined sharply in the last three quarters, and it turned negative during Q1 FY24. This explains the rather small 0.2 per cent increase in the GDP deflator despite the CPI-based inflation rate being at 4.6 per cent during the quarter. Economists, statisticians, market analysts, and all others who track the Indian economy know this simple fact. Oil prices have since soared and this will take the deflator to a higher level soon.

Due to a cooling of international oil and commodity prices, the WPI-based inflation rate has declined sharply in the last three quarters, and it turned negative during Q1 FY24. This explains the rather small 0.2 per cent increase in the GDP deflator despite the CPI-based inflation rate being at 4.6 per cent during the quarter. Economists, statisticians, market analysts, and all others who track the Indian economy know this simple fact. Oil prices have since soared and this will take the deflator to a higher level soon.

(iii) Economic resilience is corroborated by high-frequency economic indicators

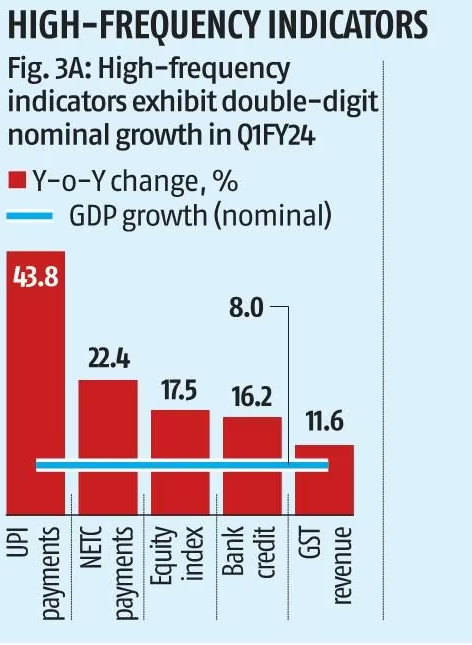

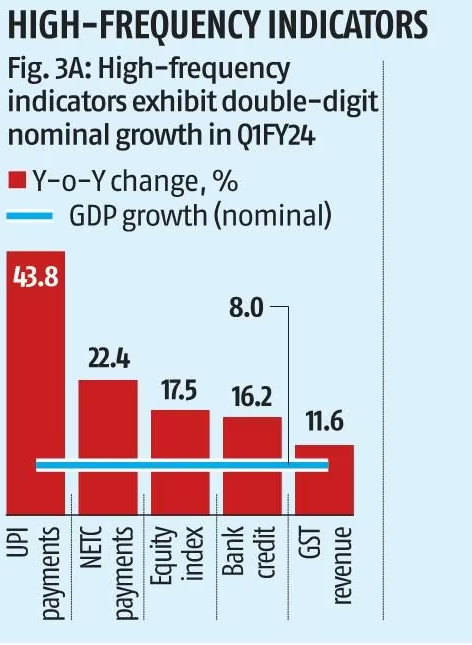

Below, we present data on several important aspects of the economy. One set of these indicators is measured in nominal values, which can serve as the pulse of nominal growth of the economy (Figure 3A). Variables as diverse as National Electronic Toll Collection (NETC), equity market index, banks credit, and goods and services tax (GST) revenue grew at double-digit rates in Q1FY24. In addition, net portfolio inflows added up to $15 billion during the quarter, compared to a net withdrawal of $14 billion in Q1 FY23; Unified Payments Interface (UPI) transactions increased by 44 per cent in value; and services exports increased to $81 billion from $76 billion in Q1 FY23.

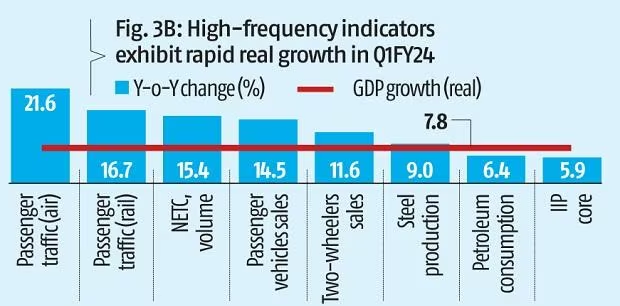

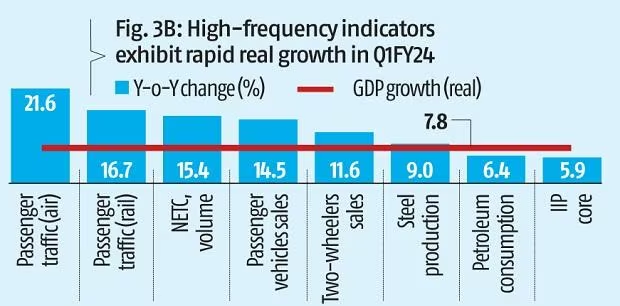

Since AJ seemed to worry about a slow moving deflator potentially causing an overestimation of real growth, our second set of variables are measured in volumes, devoid of any deflator. These can serve as the correlates of real GDP growth (Figure 3B).

Since AJ seemed to worry about a slow moving deflator potentially causing an overestimation of real growth, our second set of variables are measured in volumes, devoid of any deflator. These can serve as the correlates of real GDP growth (Figure 3B).

Here, too, variables as diverse, as passenger traffic, automobile sales, core industrial production, steel and petroleum production all showed robust growth rates.

The numbers are more consistent with an economy that is stabilising than one that is sharply decelerating.

But does this mean that the Indian economy does not face any challenges or that its data practices and quality cannot be improved? Certainly not! The Indian economy needs to continue to overcome existing and evolving challenges, especially those pertaining to the manufacturing sector, in order to sustain growth rates.

But does this mean that the Indian economy does not face any challenges or that its data practices and quality cannot be improved? Certainly not! The Indian economy needs to continue to overcome existing and evolving challenges, especially those pertaining to the manufacturing sector, in order to sustain growth rates.

A fast-growing economy needs to continuously update its policy frameworks, economic institutions, and practices, including those pertaining to data collection and usage. As such, then, there might also be a case to improve the measurement of its GDP deflator, and update its WPI and CPI baskets at regular intervals.

In conclusion, the available data does not obviate the significance of the recent performance and resilience of the Indian economy, including in the context of the concomitant global trends.

Gupta and Priyadarshini are, respectively, Director General and Research Associate at NCAER. The views expressed are personal.

Published in: Business Standard, 20 Sep 2023

Figure 1 shows the quarterly year-on-year (Y-o-Y) real GDP growth rates from Q1 FY20 till Q1 FY24. The line of linear fit shows an economy that has been accelerating. It clearly indicates that the economy contracted during Covid, recovered sharply the next year, and has thereafter been undergoing gentler recovery and acceleration.

Figure 1 shows the quarterly year-on-year (Y-o-Y) real GDP growth rates from Q1 FY20 till Q1 FY24. The line of linear fit shows an economy that has been accelerating. It clearly indicates that the economy contracted during Covid, recovered sharply the next year, and has thereafter been undergoing gentler recovery and acceleration.  The GDP deflator correlates more strongly with the WPI-based inflation (a correlation coefficient of 0.88) than with CPI-based inflation (a correlation coefficient of 0.39). In other words, WPI has a larger de facto weight in the GDP deflator than CPI. Over the past decade, the average WPI-based inflation rate has been lower than the CPI-based inflation rate (3.6 per cent versus 5.5 per cent), and two and a half times more volatile, lending volatility to the GDP deflator too.

The GDP deflator correlates more strongly with the WPI-based inflation (a correlation coefficient of 0.88) than with CPI-based inflation (a correlation coefficient of 0.39). In other words, WPI has a larger de facto weight in the GDP deflator than CPI. Over the past decade, the average WPI-based inflation rate has been lower than the CPI-based inflation rate (3.6 per cent versus 5.5 per cent), and two and a half times more volatile, lending volatility to the GDP deflator too. Due to a cooling of international oil and commodity prices, the WPI-based inflation rate has declined sharply in the last three quarters, and it turned negative during Q1 FY24. This explains the rather small 0.2 per cent increase in the GDP deflator despite the CPI-based inflation rate being at 4.6 per cent during the quarter. Economists, statisticians, market analysts, and all others who track the Indian economy know this simple fact. Oil prices have since soared and this will take the deflator to a higher level soon.

Due to a cooling of international oil and commodity prices, the WPI-based inflation rate has declined sharply in the last three quarters, and it turned negative during Q1 FY24. This explains the rather small 0.2 per cent increase in the GDP deflator despite the CPI-based inflation rate being at 4.6 per cent during the quarter. Economists, statisticians, market analysts, and all others who track the Indian economy know this simple fact. Oil prices have since soared and this will take the deflator to a higher level soon. Since AJ seemed to worry about a slow moving deflator potentially causing an overestimation of real growth, our second set of variables are measured in volumes, devoid of any deflator. These can serve as the correlates of real GDP growth (Figure 3B).

Since AJ seemed to worry about a slow moving deflator potentially causing an overestimation of real growth, our second set of variables are measured in volumes, devoid of any deflator. These can serve as the correlates of real GDP growth (Figure 3B). But does this mean that the Indian economy does not face any challenges or that its data practices and quality cannot be improved? Certainly not! The Indian economy needs to continue to overcome existing and evolving challenges, especially those pertaining to the manufacturing sector, in order to sustain growth rates.

But does this mean that the Indian economy does not face any challenges or that its data practices and quality cannot be improved? Certainly not! The Indian economy needs to continue to overcome existing and evolving challenges, especially those pertaining to the manufacturing sector, in order to sustain growth rates.